Chapter 8

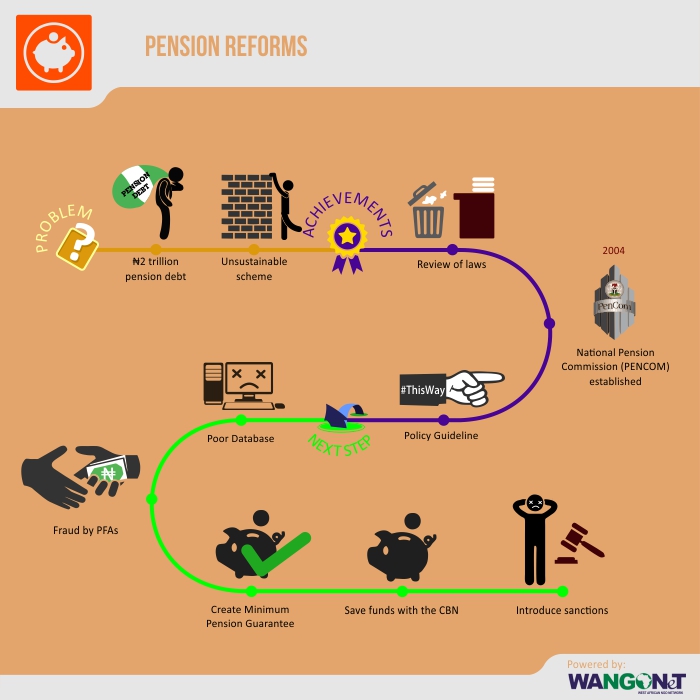

Pension Reforms

Background

In 2003, government’s pension liabilities from a fully funded ‘Pay-As-Go’ defined benefits pension scheme was ₦2 trillion; as the amount budgeted annually for pensions was often cut, funds to pay pensions were untimely and inadequately released, and as there was no way of investing and increasing funds accumulated in some schemes instituted by some government parastatals, and as the pensioner-active worker ratio was unstable. Lack of a pensioners database, which allowed fraudulent individuals to be receiving pensions, made its contributions.

Past Reform and Achievements

On 25 June 2004, the federal government enacted the Pension Reform Act 2004. It came into effect on 1 July 2004. The Act provided for a contributory and mandatory pension scheme with contributions from both employees and employers. The scheme is privately managed by strictly supervised and regulated Pension Fund Administrators (PFAs) and Pension Fund Custodians (PFCs), with the assets having a 100% asset backing. The newly established National Pension Pension Commission (PENCOM) provides the supervision and regulation.

The Pension Transitional Arrangement Department (PTAD) was established in to continue to administer the affairs of pensioners, who retired before the implementation 1 July 2007 start day for the new scheme. In less than 2 years the department weeded out 15,000 ‘ghost pensioners’ and saved the government N2 billion. The contributory pension scheme, wherein employers and staff make fixed percentage contributions towards the staff’s retirement, on the other hand drastically reduced the cost of pensions to government, with anyone who works for the government however briefly entitled to receiving pensions – in direct contrast to the old scheme which requires 10 years of work to be eligible.

Challenges and Next Steps

A comprehensive database of pensioners needs to be established. MDAs that are currently in the practice of delaying paying the pension deductions from staff’s salaries, should be sanctioned. A national mortality data-driven model that could more accurately inform calculations about pension duration and annuities should be worked upon. Workers and pensioners should be made aware of the rights and processes the contributory pension scheme, towards checking underhand practices by some PFAs. MDAs refusing to move to the new scheme should be compelled to do so. Pension accounts should be transferred to the Central Bank to reduce corruption in pension administration.