Chapter 10

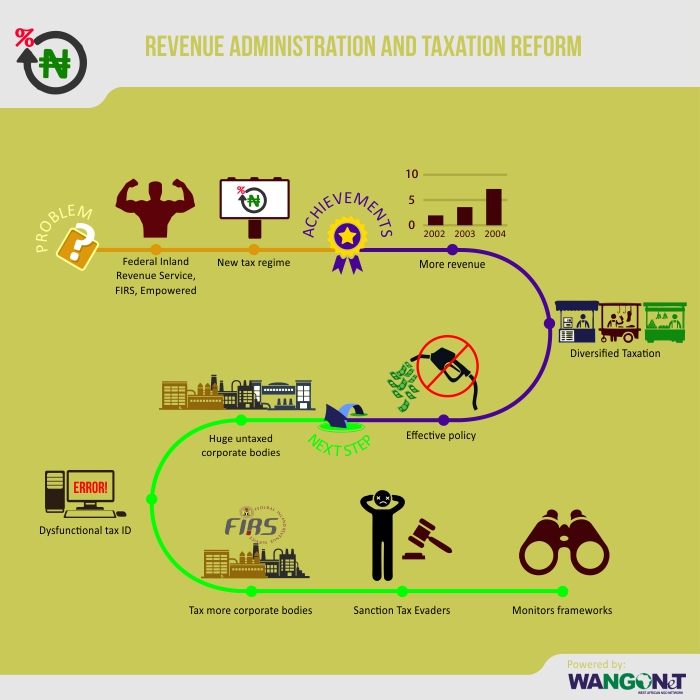

Revenue Administration and Taxation Reforms

Background

Tax administration in Nigeria changed dramatically in 2007 with the granting of financial and administrative autonomy to the Federal Inland Revenue Service (FIRS) after the passage of the Federal Inland Revenue Service (Establishment) Act 2007.

Past Reform and Achievements

The Study Group (2002) on the Nigerian Tax System, and the subsequent Working Group (2003) which reviewed the work of the former, helped to develop a new national tax policy. In 2004 the reorganization of the FIRS to ensure efficiency and effectiveness was commenced. Departments and units were created for effective management of tax operations. In June 2007, the ‘group system’ structure in which roles and functions pass from the group levels to departmental levels down to unit levels and finally to individual levels, was introduced.

A presidential committee was inaugurated in 2005 to drive the recommendations of the Study and Working Groups on the development of a national tax policy. The Committee appointed a Technical Sub-Committee on the National Tax Policy and charged it with the responsibility of developing the background policy document. In 2010, the final draft of the National Tax Policy was submitted. The National Tax Policy was adopted on 20 January 2010.

Between 2005 and 2011, six recommendations of the Presidential Technical Committee were assented to by the National Assembly. One of such is the autonomy of the FIRS from the civil service bureaucracy in the areas of funding and human resource management. The Federal Inland Revenue Service (Establishment) Act 2007 established the Tax Appeal Tribunal to settle disputes arising from the operations of the Act. In March 2012, the Corporate Development Group (CDG) was renamed Modernization Group, so as to focus on modernization projects and ensure processes are technology-enabled. Prior to reform, there was no policy framework of ethics or values defining the operations of FIRS staff. However, in 2005, the Values and Doctrine Division, built on the foundations laid by the ‘Whistle blower’ blueprint, was established.

In 2008 the collection of ₦2.972 trillion was over and above the cumulative collection for the ₦2.682 trillion collected in the eight-year period 1996–2003. The tax collected would further increase to ₦4.8 trillion by 2013.

Challenges and Next Steps

The many corporate organizations yet to be captured in the tax database should be urgently listed. Those in the database that do not pay their taxes should be compelled to do so. The Tax Identification Number system should be operationalized across the nation. Transparency should be built into the operation of Government waivers. FIRS should be increasingly strengthened.